|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Vermont Refinance Mortgage Rates and Their ImpactIntroduction to Vermont Refinance Mortgage RatesWhen considering refinancing your mortgage in Vermont, understanding the current refinance mortgage rates is crucial. These rates can significantly impact your monthly payments and overall loan cost. Factors Influencing Refinance Rates in VermontEconomic IndicatorsSeveral economic factors influence refinance mortgage rates. These include the federal interest rate, inflation, and the overall economic climate. Credit Score ImpactYour credit score plays a vital role in determining your refinance rate. Higher scores typically result in lower rates, making it essential to maintain good credit health.

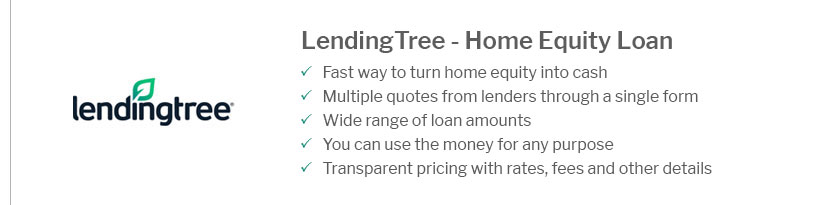

Benefits of Refinancing Your MortgageRefinancing can provide several advantages, such as reducing your interest rate, shortening your loan term, or refinance mortgage with cash out option to access home equity. Cost SavingsLower interest rates can lead to significant savings over the life of the loan. Improved Loan TermsRefinancing might allow you to switch from an adjustable-rate mortgage to a fixed-rate mortgage, providing more stability. Steps to Refinance Your Mortgage in Vermont

It's also possible to refinance mortgage with different lender if it offers better terms or customer service. FAQ Section

https://www.bankrate.com/mortgages/mortgage-rates/vermont/

As of Friday, January 24, 2025, current mortgage interest rates in Vermont are 7.69% for a 30-year fixed mortgage and 6.94% for a 15-year fixed mortgage. https://www.nerdwallet.com/mortgages/mortgage-rates/vermont

Offers a full selection of mortgage types and products, including jumbo, home equity, and government loans. Claims to offer preapproval within 24 hours of loan ... https://www.zillow.com/mortgage-rates/vt/

The current average 30-year fixed mortgage rate in Vermont increased 13 basis points from 6.59% to 6.72%. Vermont mortgage rates today are 5 basis points higher ...

|

|---|